us japan tax treaty article 17

This Convention shall apply only to persons who are residents of one or both of the. D the term tax means Japanese tax or United States tax as the context requires.

This Week In Tax Imf Pushes Japan To Raise Taxes International Tax Review

Foreign tax relief.

. Protocol PDF - 2003. 2017 tax law Pub. The present convention shall also apply to any other tax on estates inheritances or gifts which has a character substantially similar.

It does not apply to a US Citizen or Permanent Resident of the United States involving benefits from the United States. Therefore if a US person earns public pension from work performed in Japan then they can claim that it is only taxable in Japan. In addition the quasi-tax treaty with Tiwan is effective.

Pursuant to Article 30 the treaty generally is applicable with respect to withholding taxes on July 1 2004. The United States -Japan tax treaty which was signed on November 6 2003 entered into force on March 30 2004. The entries for regular post office accounts will show gross income along with withholding tax 20315.

Although the Protocol was signed on 25 January 2013 Japan time and approved by the Japanese Diet on 17 June 2013. A convention between the United States of America and Japan for the avoidance of. July 11 2019.

C the terms a Contracting State and the other Contracting State mean Japan or the United States as the context requires. The protocol to amend the Japan-US tax treaty entered into force on 30 August 2019. The Federal estate and gift taxes.

From tax by the other state. Form 17 for various countries are shown below. The Government of Japan and the Government of the United States of America Desiring to conclude a new Convention for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income Have agreed as follows.

Convention Between the United States of America and Japan for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income signed at Tokyo on March 81971. In the case of US. A taxpayer wishing to claim.

While Japan ratified the protocol in the Diet on June 17 2013 ratification on the US side had been held. Japan - Brazil Tax Treaty. The inheritance tax including the gift tax.

Technical Explanation PDF - 2003. You can find official information on Japans tax treaties tax conventions on the website of Ministry of Finance Japan please see below. Japan-US Tax Treaty 2013 protocol entered into force on 30 August 2019 the date Japan and the US exchanged instruments of ratification and applies to withholding taxes on dividends and interest paid or credited on or after 1 November 2019.

Article 4-----General Treaty Rules Article 5-----Avoidance of Double Taxation Article 6-----Source Rules. The taxes referred to in the present convention are. E the term person includes an.

Income Tax Treaty SUMMARY On January 24 2013 Japan and the United States signed a protocol together with an exchange of notes related thereto the Protocol amending the income tax treaty signed by the two countries in 2003 as. US Netherlands UK Switzerland. Withholding taxes the treaty is applicable for amounts paid or credited on or after July 1st.

UNITED STATES - JAPAN INCOME TAX CONVENTION A Convention Between The United States And Japan For The Avoidance of Double Taxation And The Prevention of Fiscal Evasion With Respect to Taxes on Income Was Signed at Tokyo on March 8 1971. Japan has concluded 69 comprehensive tax treaties in force which are applicable to 77 jurisdictions as of 1 January 2022. Attachment for Limitation on Benefits Article.

Article 17 Pension in the US Tax Treaty with Japan Subject to the provisions of paragraph 2 of Article 18 pensions and other similar remuneration including social security payments beneficially owned by a resident of a Contracting State shall be taxable only in. 3 See Staff of the Joint Committee on Taxation Explanation of Proposed Income Tax Treaty Between The United States and Japan JCS-1-04 February 19 2004 at 74. The instruments of ratification for the protocol to amend the existing Japan-US tax treaty Protocol were exchanged between the two governments and entered into force on 30 August 2019.

Form 17 - US PDF381KB Form 17 - UK applicable to payments made before December 31 2014 PDF399KB Form 17 - UK applicable to payments made on and after January 1 2015 PDF428KB Form 17 - France PDF421KB Form 17 - Australia PDF395KB Form 17 - Kingdom of the Netherlands PDF521KB. Japan - Tax Treaty Documents. On August 30 2019 the governments of Japan and the United States of America exchanged instruments of ratification for a new.

A protocol to the US-Japan Tax Treaty which implements various long-awaited changes entered into force on August 30 2019 upon the exchange of instruments of ratification between the Government of Japan and the Government of the USA. Article 17-----Independent Personal Services Article. The Government of the United States of.

Japan has concluded 65 tax treaties which apply to 96 jurisdictions shown in the Annex. Japan Inbound Tax Legal Newsletter August 2019 No. Tax Treaty Japan and the United States Sign a Protocol Amending the Existing Japan-US.

TECHNICAL EXPLANATION OF THE UNITED STATES-JAPAN INCOME TAX CONVENTION GENERAL EFFECTIVE DATE UNDER ARTICLE 28. Although the Protocol was signed on 25 January 2013 and approved by the Japanese Diet on 17 June 2013 it took 6 years and 7 months from the signature to the enactment due to additional time necessary for US ratification procedures. Resident taxpayers can credit foreign income taxes against their Japanese national tax and local inhabitants tax liabilities with certain limitations where foreign-source income is taxed in Japan.

While Japan ratified the Protocol in the Diet on June 17 2013 ratification on the US-side had been. This will result in approximately 15600 US. In an effort to strengthen the bilateral.

Treasury Department and IRS today released for publication in the Federal Register final regulations TD. Income Tax Treaty PDF- 2003. Article 17 Pension in the US Tax Treaty with Japan.

Any other United States possession or territory. Decree signed in 14 December 1967. Articles 17 and 18 provide that under certain circumstances an individual who is a resident of one state shall be.

115-97the law that is often referred to as the Tax Cuts and. Non-resident taxpayers are not entitled to take foreign tax credits on their Japan income tax returns unless one has a PE. In the case of the United States of America.

Protocol Amending the Convention between the Government of the United States of America and the Government of Japan for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes on Income PDF 2013. The provisions of paragraph 4 shall not affect the benefits conferred by a Contracting. A protocol the Protocol to the US-Japan Tax Treaty the Treaty which implements various long-.

In the case of Japan. CONVENTION BETWEEN THE FEDERATIVE REPUBLIC OF BRAZIL AND JAPAN FOR THE AVOIDANCE OF DOUBLE TAXATION WITH RESPECT TO TAXES ON INCOME. 9870 that streamline existing regulations by removing rules that are no longer necessary after the enactment of the US.

USJapan treaty Article 45a of the UKJapan treaty Article 46a of the.

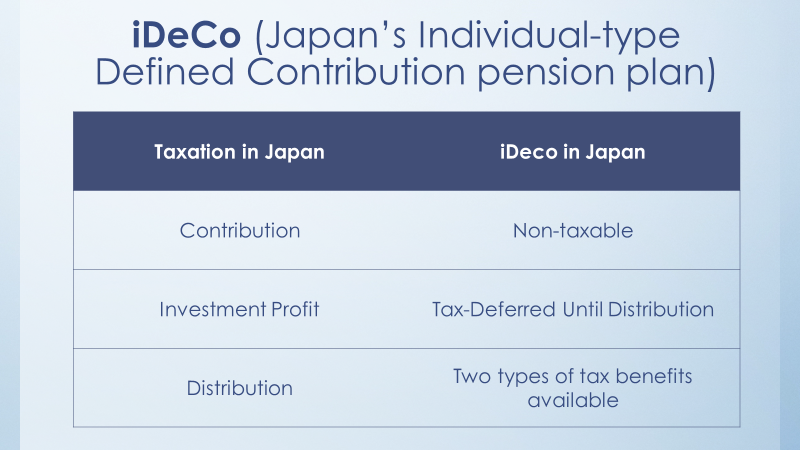

Help Your Japanese Spouse Retire In Japan By Using Ideco Cdh

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Guide On Completing The Application For Entitlement To Reduced Tax Rate On Domestic Source Income For Foreign Corporation Form No 72 2

Japan United States International Income Tax Treaty Explained

Japan United States International Income Tax Treaty Explained

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Form 8833 Tax Treaties Understanding Your Us Tax Return

Pdf Tax Treaties And The Taxation Of Non Residents Capital Gains

Us Mt New Arrangement Clarifies Pension Fund Kpmg Global

Unraveling The United States Japan Income Tax Treaty And A Closer Look At Article 4 6 Of The Treaty Which Limits The Use Of Arbitrage Structures Sf Tax Counsel